CONNECT. LEARN. | 2 SUPERPOWERS. 1 WEEKEND

A Journey Concluded,

A Legacy Continued!

We appreciate your visit to our conference page. Though DECMA 2024 has ended, we will be back with DECMA 2025 next year with more learnings, more insights and more networking opportunities.

Till then, stay tuned!

NOV 9th - 10th, 2024

₹21,999/-

₹15,499/-

Registration cost is exclusive of GST. It includes 2-day conference with all meals. No Stay.

Annual Trading Conference

0

th

Participants Every Year

0

+

Years of Industry

Experience

Experience

0

+

Speakers

0

Sessions

0

WHAT DECMA 2024 OFFERED?

A WEEKEND TO LEARN, CONNECT & GROW TOGETHER

Strategies Designed and Tested by Experts

Attendees had the opportunity to explore unique, backtested strategies crafted by seasoned mentors.

Why Trade Alone?

Many of our traders found their tribe among their like-minded peers, connecting, sharing, and growing together.

Learned From the Best

Attendees didn’t just learn—they connected with mentors, asked questions, and shared ideas over coffee, making DECMA 2024 a truly unforgettable experience!

Your Questions, Answered

Through numerous trader-focused discussions, our mentors addressed challenges and our attendees gained valuable insights.

KNOWLEDGE X LIFE LONG CONNECTIONS = DECMA

You may have often felt like it was you versus the ever-changing stock market. The only way to thrive and grow in the dynamic market is through two things – Connections and Learning. At DECMA 2024, we aimed to empower you with these two essential pillars for thriving in a dynamic market.

DECMA (Definedge Conference on Market Analysis) has a legacy of 6 years, helping over 1800 traders and investors. Each year we bring the best minds of the industry to enlighten and inspire our participants and forge lifelong bonds with their peers.

This year was no different. DECMA 2024 was our 13th annual conference, and we were able to raise the bar for the 13th time, all thanks to our wonderful attendees and their commendable participation

This weekend is all about YOU – your growth, your goals, and your ambitions!

It was a weekend of learning from mentors, connecting with their peers and growing together in a thriving community. From novices to seasoned traders, DECMA 2024 offered an unforgettable experience for everyone —just as we promised.

Our Motivation: Love from the DECMA Community

RELIVE DECMA 2024 CELEBRATING LEARNING & GROWTH

As we reflect on the incredible journey of DECMA 2024, we extend our heartfelt gratitude to each participant who made this event a success.

Our Speakers

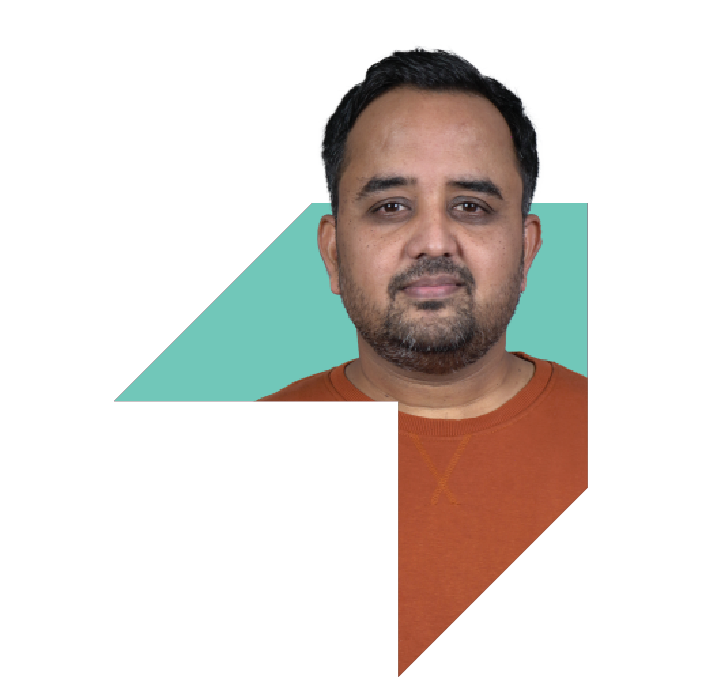

Nifty and BankNifty Renko Swing Trading Strategy

Biren Patel

A Technical Analyst to a Full-time System-based Trader

With 30 years of market experience, Biren Patel's journey from a technical analyst to a full-time system-based trader is extraordinary.

He began his trading career in 1994 as a dealing head at a renowned financial firm. Over the years, he climbed the corporate ladder, transitioning from technical analyst to institutional dealer, before discovering his true passion for trading in 2017.

Now a mentor, Biren empowers others with his mantra, "System Bhagwan chhe."

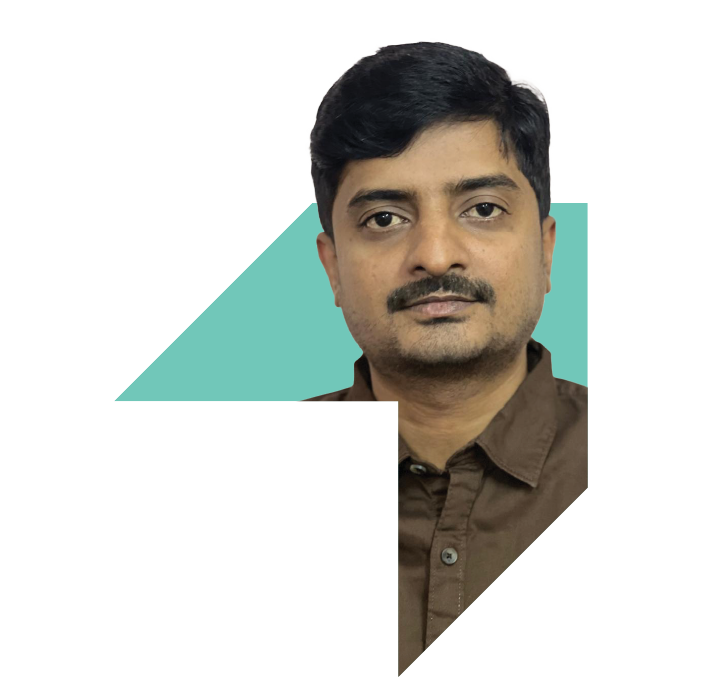

TechnoFunda Investing with P&F Charts

Gaurav Bajaj

Chartered Accountant Turned Successful Investor

Driven by a deep-rooted belief in the power of passive income, Gaurav is passionate about guiding individuals towards financial freedom through strategic investment strategies.

He is a strong proponent of objective trading techniques, emphasising the importance of disciplined systems and risk management.

Intraday Options Trading Strategy

Ravi Shinde

From Humble Beginnings to a Successful Trader

Ravi’s journey from a curious college student to a full-time trader is of perseverance and passion. A breakdown of capital in options trading in 2011, he took a ten-year break from the market.

His early losses taught him a hard lesson—trading is not just about profits but also about strategy and discipline.

Mastering Renko charts and disciplined strategies, he transformed into a successful trader.

A must-learn from his journey is that “every trade is a win or a lesson—never regret it.”

Credit Spreads to Identify Underlying Trends

Vishwanath Nagaraj

Passionate Trader with a focus on options trading and credit spreads.

Developed a successful trading approach based on technical analysis and overcame initial trading challenges through dedicated learning and guidance.

He continuously seeks growth in both his corporate career and trading endeavours.

Scalping in Index Options Using Noiseless Charts

Hitesh Gandhi

Engineer turned full-time trader

A former corporate professional who transitioned into full-time intraday trading after 33 years in the industry.

To carve out his niche, he mastered options trading and drastically improved his strike rate within just six months of fully committing to trading in 2023.

A passionate learner and networker, he continues to hone his skills, inspiring new traders to embrace lifelong learning.

Scalping in Index Options Using Noiseless Charts

Subramanya Joshi

Investment Banker Turned Intraday Trader

He is an investment banker who found his true passion in intraday trading. Inspired by a family member, he began his journey in 2006 and made it his full-time career by 2020.

The COVID market crash and the losses were his biggest learnings, pushing him to refine his strategies and master techniques like Camarilla levels and P&F charting.

He has evolved as a Scalper in Options Trading and an Intraday Trader.

The Mind & Method For Spotting Multibaggers

D Prasad

From IPO investing to Picking Multi-baggers

A market veteran with nearly 35 years of trading experience, transformed from an aspiring Chartered Accountant to an experienced investor and trader.

A single IPO excited him, as it soared 500% in three months, igniting his passion for the markets. Over the years, he has led the research at a broking firm and contributed to behavioural finance and trading psychology.

Known for spotting multi-bagger stocks, he combines technical and fundamental analysis.

Prasad emphasises mastering both the mind and the method, empowering traders to understand themselves before pursuing success.

Fusion Of VCP & Anchor Column

Prakash Tejwani

Being Headstrong

An inspiring journey from owning a CD library to becoming a successful trader is a tale of transformation.

He started his trading journey in 2003 as a sub-broker with minimal market knowledge. After years of steady learning, a significant setback came in 2020 when he lost half his wealth during the market crash.

Being stubborn is sometimes positive - Refusing to give up, he embraced the philosophy of "Karm Kar, Fal ki Chinta Mat Kar" (Focus on effort, not results), dedicating himself to mastering process-based, disciplined trading.

A turning point arrived in 2021 when he discovered noiseless charts with Definedge, revolutionising his approach. Today, Prakash has achieved more success in the past year than in his previous 20 years, sharing his story and insights to inspire others in the trading community.

Options Have Many Options

Sunil Monga

A Journey of Real Estate Investor to an Options Trader

Founder of Asseto Motto, Sunil has 20+ years of experience in the hospitality industry and is now a thriving options trader.

His investment journey began with real estate and evolved into options trading after discovering the power of financial markets.

Today, he creates multi-leg stock options strategies and shares his knowledge, helping others unlock financial security through trading

Power Of Long Term Charts Using Price & Volume

Vijay Thakkar

A Believer in - No Shortcuts, Just Focus and Discipline

Starting in sales, he later became a sub-broker, facing many setbacks but learning valuable lessons and becoming a mentor for thousands of traders – a journey of hard work.

Determined to succeed, Vijay embraced chart analysis and market behaviour, using YouTube and free seminars as his training ground.

Through years of dedication, he mastered positional trading, firmly believing that success comes from perfecting one strategy—no shortcuts, just focus and discipline.

Today, Vijay inspires the trading community with his mantra, "Know Yourself", which encourages them to master one skill to achieve true success.

The Application Of Artificial Intelligence (AI) In Stock Market Trading.

Dhaval Makwana

Futuristic AI Trader

A pioneering Data Scientist and Futuristic Trader who is redefining the trading landscape with AI.

Since starting his trading journey in 2019, he has focused on developing automated trading models, persevering through the market's complexities. Leveraging his tech expertise, he created custom automated trading tools, overcoming initial data challenges.

Dhaval's advice for aspiring traders emphasises education, self-discovery, and finding the right mentors, reminding them that trading is a marathon, not a sprint.

Curious about AI in trading? He highlights that while AI is rising, human judgment remains paramount.

Unique Intraday & Short-Term Trading Setups

Mangesh Joglekar

Take A Deep Breadth 5-in-1 (5Trading Strategies)

Raju Ranjan

Take A Deep Breadth 5-in-1 (5Trading Strategies)

Abhijit Phatak

Simple Options Strategies

Raghunath Reddy

Effective Momentum Investing & Trading Strategies

Prashant Shah

Event Agenda

NOV 9th - 10th, 2024

Day 1 : 10:00 am to 7:00 pm

Day 2 : 9:00 am to 6:00 pm

DAY 1

DAY 2

DAY 1

|

|

Registration & Breakfast

|

9:00 – 10:00 |

|

|

Welcome Note By Prashant Shah

|

10:00 – 10:30 |

|

|

Take A Deep Breadth 5-in-1 (5 Trading Strategies)

Abhijit Phatak & Raju Ranjan |

10:30 – 12:00 |

|

|

The Mind & Method For Spotting Multibaggers

D Prasad |

12:00 – 13:00 |

| Lunch | 13:00 – 14:00 | |

|

|

Options Have Many Options

Sunil Monga |

14:00 – 15:00 |

|

|

Nifty And Banknifty Renko Swing Trading Strategy

Biren Patel |

15:00 – 16:00 |

| High Tea | 16:00 – 16:15 | |

|

|

Power Of Long Term Charts Using Price & Volume

Vijay Thakkar |

16:15 – 17:15 |

|

|

The Application Of Artificial Intelligence (AI) In Stock Market Trading

Dhaval Makwana |

17:15 – 18.15 |

|

|

Networking & Dinner

|

18:15 Onwards |

DAY 2

|

|

Breakfast

|

8:00 – 9:00 |

|

|

TechnoFunda Investing with P&F Charts

Gaurav Bajaj |

9:00 – 10:00 |

|

|

Intraday Options Trading Strategy

Ravi Shinde |

10:00 – 11:00 |

| Tea Break | 11:00 – 11:15 | |

|

|

Scalping In Index Options Using Noiseless Charts

Hitesh Gandhi & Subramanya Joshi |

11:15 – 12:15 |

|

|

Credit Spreads To Identify Underlying Trends

Vishwanath Nagaraj |

12:15 – 13:15 |

| Lunch | 13:15 – 14:30 | |

|

|

Fusion Of VCP & Anchor Column

Prakash Tejwani |

14:30 – 15:30 |

|

|

Unique Intraday & Short-Term Trading Setups

Mangesh Joglekar & Raju Ranjan |

15:30 – 16.30 |

| High Tea | 16:30 – 16:45 | |

|

|

Effective Momentum Investing & Trading Strategies

Prashant Shah |

16:45 – 17.45 |

|

|

Conclude

|

17:45 |

OUR SPONSORS

Venue

Gateway to the Financial Capital

MUMBAI

₹21,999/-

₹15,499/-

Registration cost is exclusive of GST. It includes 2-day conference with all meals. No Stay.

Ready to be a part of DECMA?

FAQs

In case we left a few questions to be answered, here you go!

Unfortunately, accommodation is not included in the registration this year. Attendees will need to arrange their own stay, but don’t worry—Mumbai offers plenty of amazing options.

No, the registration fee is non-refundable.

However, in case of exceptional circumstances, reach out to us and we will try to find a solution together!

Your registration fee secures your spot at DECMA 2024 and covers the meals provided during the event.

Please note – The registration fee mentioned excludes GST.

We are holding DECMA in the Maximum City – Mumbai this year.

The exact venue location, agenda, and speaker lineup will be announced soon, so keep an eye on our social channels or bookmark this page to be the first to know.

Yes!

Absolutely! There’s no time to lose if you want to be at DECMA 2024, register now. RIGHT NOW!

No, the event will not be recorded. If you wish to learn from our speakers, register now.

At DECMA 2024, some sessions will be conducted in English, while others will be in Hindi.

Look who’s here! YOU MADE IT TO THE END. CHEERS!

Just so you don’t forget. Save the Date

NOVEMBER 9th & 10th, 2024

Waiting for you to find us at:

Write to us at – [email protected] (We do not accept letters anymore. Only emails! 😉)

Or just ring us at – 020-61923200